Illicit Trade

*All figures taken from Revenue Tobacco Surveys 2013-22

What is illicit trade?

All legitimate tobacco products sold on the Irish market must display a relevant duty paid Irish tax stamp. Product being sold or supplied in Ireland that does not display this stamp is classed as illicit product.

There are three categories in which illicit tobacco products fall under:

- Contraband – Genuine brands smuggled from one low tax/excise country to a higher tax country. Often seen as Duty Free product which is smuggled into Ireland and sold illegally

- Counterfeit – Product illegally produced and made to replicate genuine product

- Illicit Whites – Cigarettes commonly produced legitimately for export by small tobacco manufacturers throughout the world but illegally smuggled into Ireland. The majority of products found in Ireland has originated from countries such as Singapore, Vietnam and the UAE.

Current situation

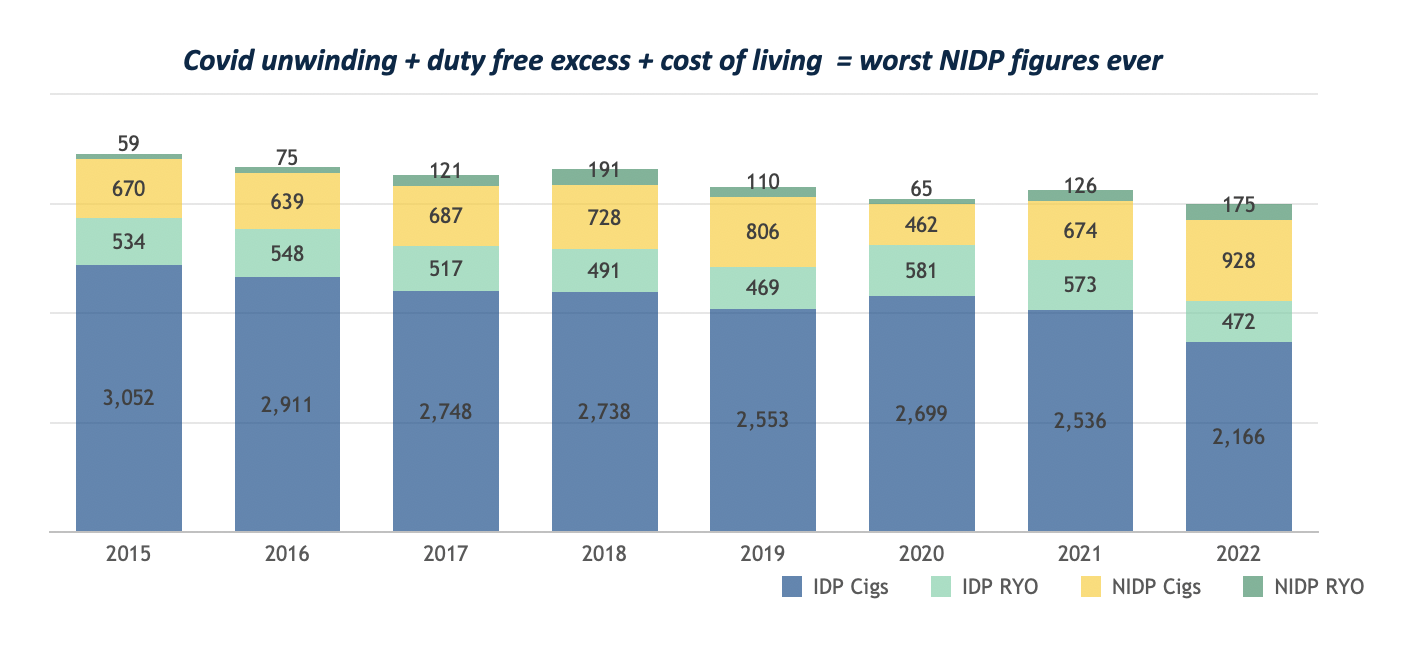

Itmac Total Market Overview – Total Consumption

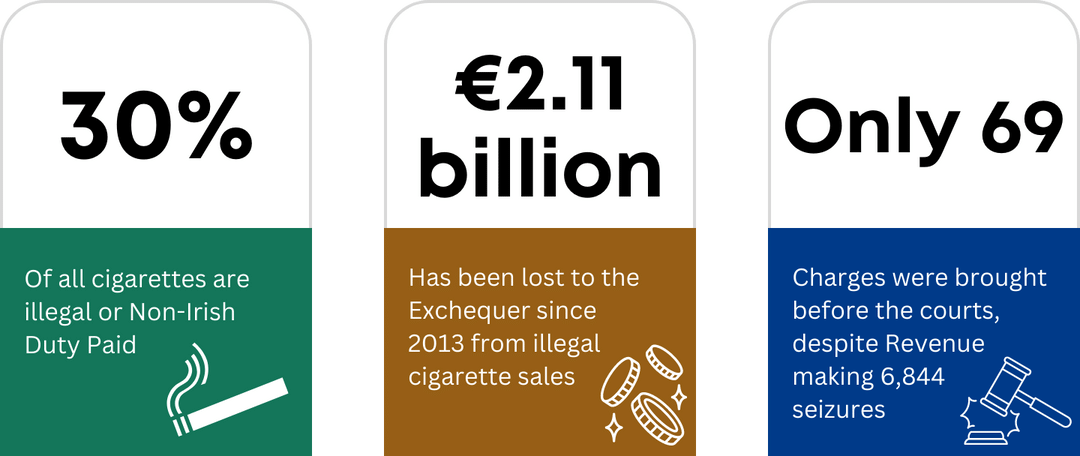

- Revenue’s Illegal Tobacco Products Research Survey 2022 found that approximately 634 million illegal cigarettes (31.7 million packs) were consumed in Ireland in 2022, representing a loss to the Exchequer of approximately €384 million.

- Nearly 1 in 3 adult smokers in Ireland do not purchase cigarettes from any Irish shop.

- This accounts for approximately 30% of the market of which Revenue estimates that 17% is illicit while the remaining 13% is purchased abroad.

Sourcing and smuggling illegal tobacco products

Smugglers source and smuggle illegal product in several different ways. These include:

- Smuggling large consignments of cigarettes in containers or within genuine cargo from the Far and Middle East

- Van and car drivers transporting illicit product on board passenger ferries from Europe

- Illegal product being posted to Ireland

- Ant smugglers bring back product in suitcases from cheaper countries such as he Canaries and Baltic States

- Returning holiday makers arriving back with excess amounts of product to sell

- These smuggled products can be counterfeit, contraband or Illicit whites depending on where the smugglers source them

2022 was a major year for illegal cigarette seizures:

- 51.4 million cigarettes seized

- Nearly 12 tonnes of loose and roll your own tobacco product were seized

- 10 million cigarettes seized at Rosslare Port valued at over €7.9 million (29 November 2022)

- 3 tonnes of tobacco and 4.5 million cigarettes worth €5.5 million seized by Revenue at Dublin Port (30 August 2022)

Illegal sales in Ireland

- Illegal tobacco products still sold in traditional ways including street markets.

- Word of mouth, e.g. contacts made in smoking areas of certain pubs, bookmakers, etc.

- Via the internet, particularly through ads placed on social media e.g. Facebook accounts. This route to market is of growing concern to the industry due to the easy access to a large, targeted audience and the total lack of regulation when it comes to the age profile of potential purchasers.

What drives the illicit tobacco trade?

The illicit trade is driven primarily by price and the significant profits that criminal groups and individuals involved in the trade can make from smuggling and selling illicit tobacco products. As they pay no excise or tax on the smuggled product, they have a big margin to work within. That facilitates the growth of criminality in communities and allows criminal gangs to flourish and prosper. Furthermore, the people involved in the smuggling, distribution and sale of illicit tobacco products have no qualms about selling to and indeed, often using children to sell their product on the streets. The illicit tobacco trade offers consumers a value for money option compared to the high prices of legitimate tobacco in Ireland and the people involved continue to seek out new ways of supplying its target audience.

Over the last number of years, the Irish Government has taken the approach of significantly increasing excise duty on tobacco products. This has seen duties increase by 58% since 2014 and today sees a legitimate pack of 20 cigarettes retailing at up to €15.80 with similar illicit packs being sold for as little as €5. This price difference between legally sold and illegal tobacco products remains the single biggest contributory factor.

Impact of illicit trade

The citizens of Ireland and taxpayers are ultimately the biggest losers because of the illicit trade. Figures released from Revenue for 2021 show the illegal trade at 17% this equates to an excise loss of €384 million to the Exchequer. With the government not collecting these monies, it allows general taxes to remain at a high level to make up the shortfall and local and national services throughout the country suffer.

Other significant losers from this trade are the genuine retailers, who because of illegal selling in their community no longer see genuine customers visiting their store. A typical retailer reports tobacco sales to be an average of 20% of their overall turnover.

Who is the ultimate winner?

Organised crime groups and individuals involved in the illegal trade are big winners. The people at the top of the chain make the most profit but everyone involved to the street or end seller take a little profit from it. It is believed that the major organised crime groups use the vast profits to fund further criminal activities such as drugs and gun smuggling. In 2022, 51.6 million cigarettes and over 11.8 tonnes of loose and roll your own tobacco product were seized. If these tobacco products had not been detained, and all product had been sold on our streets, it would have resulted in a windfall for criminal gangs.

Tackling the illicit market

Revenue confirmed that 2022 was a major year for tobacco and cigarette seizure. 51.6 million cigarettes seized and nearly 12 tonnes of loose and roll your own tobacco product were seized in 2022.

Smugglers are continuously adapting their methods and making it increasingly difficult for the Customs or Gardai to identify illegal consignment or routes and to conduct seizures. The authorities primarily charged with tackling cigarette smuggling are under resourced and subsequently are unable to develop intelligence or conduct enforcement action that would reduce the illicit trade or at least make it more difficult for the people involved.

The government needs to realise its excise strategy is not working. Year on year it fails to bring in the projected funds from excise duties, creating a lucrative market for criminals to thrive and failing hard working retailers from earning an honest living. We believe law enforcement agencies do have the necessary legislation to tackle these individuals however current laws, such as seizing cars and vans that have been used to transport illegal product, need to be enforced.