Excise

Excessive excise on cigarettes encourages cross-border trade, smuggling of tobacco products, internet purchases and even domestic production of counterfeit tobacco products

As tobacco taxes have risen, so has tax evasion. Tax-induced smuggling has become so widespread that it undermines both the revenue and health goals of higher cigarette taxes, while producing unintended consequences for Irish society, such as criminal activity and negative impacts on small businesses.

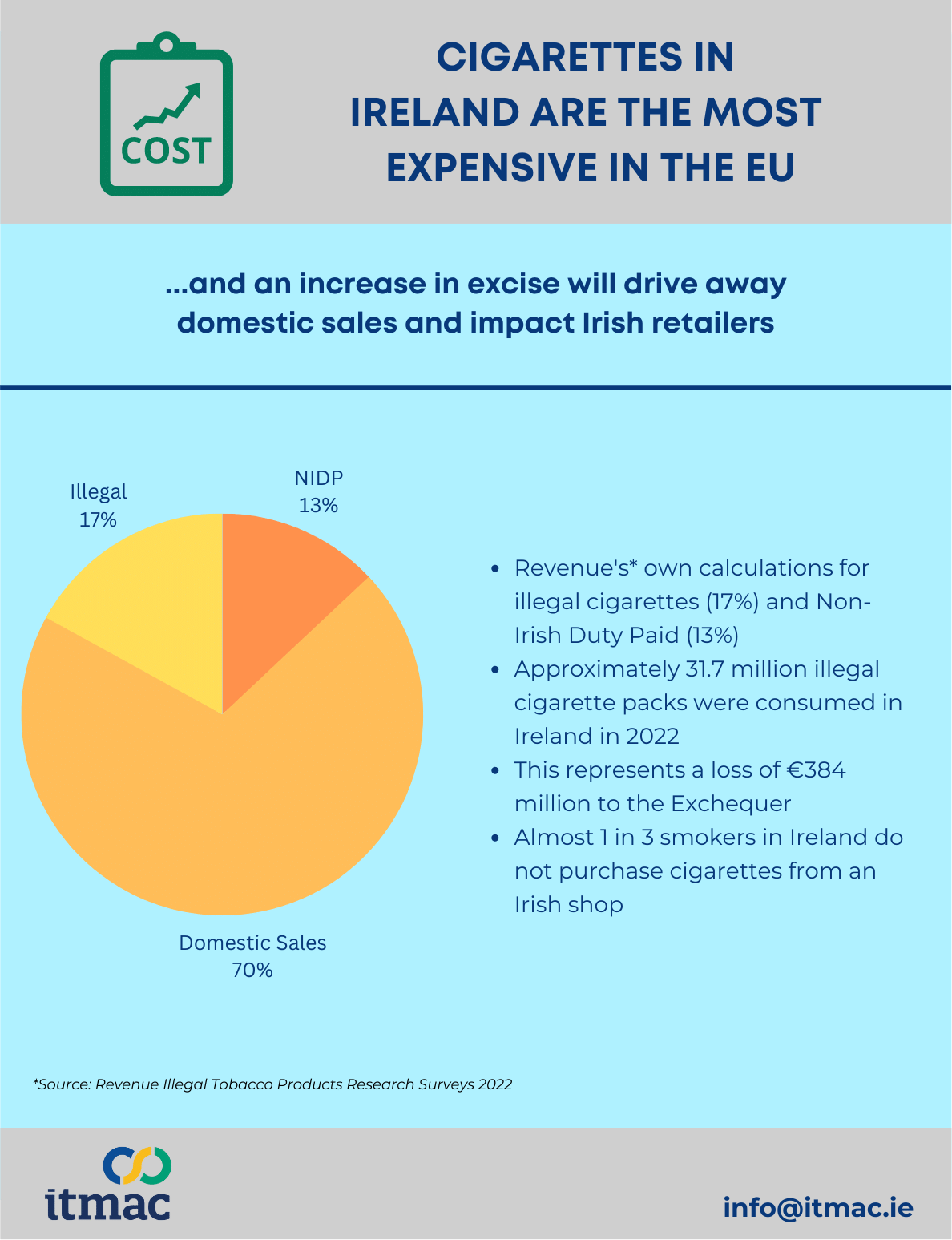

The discovery of an illegal cigarette factory alongside the border in Louth in 2018 is huge cause for concern and shows that the criminality surrounding the illicit trade is growing in sophistication. According to Revenue’s 2022 Illegal Tobacco Survey, approximately 634 million illegal cigarettes (31.7 million packs) were consumed in Ireland costing taxpayers €384 million in 2022.

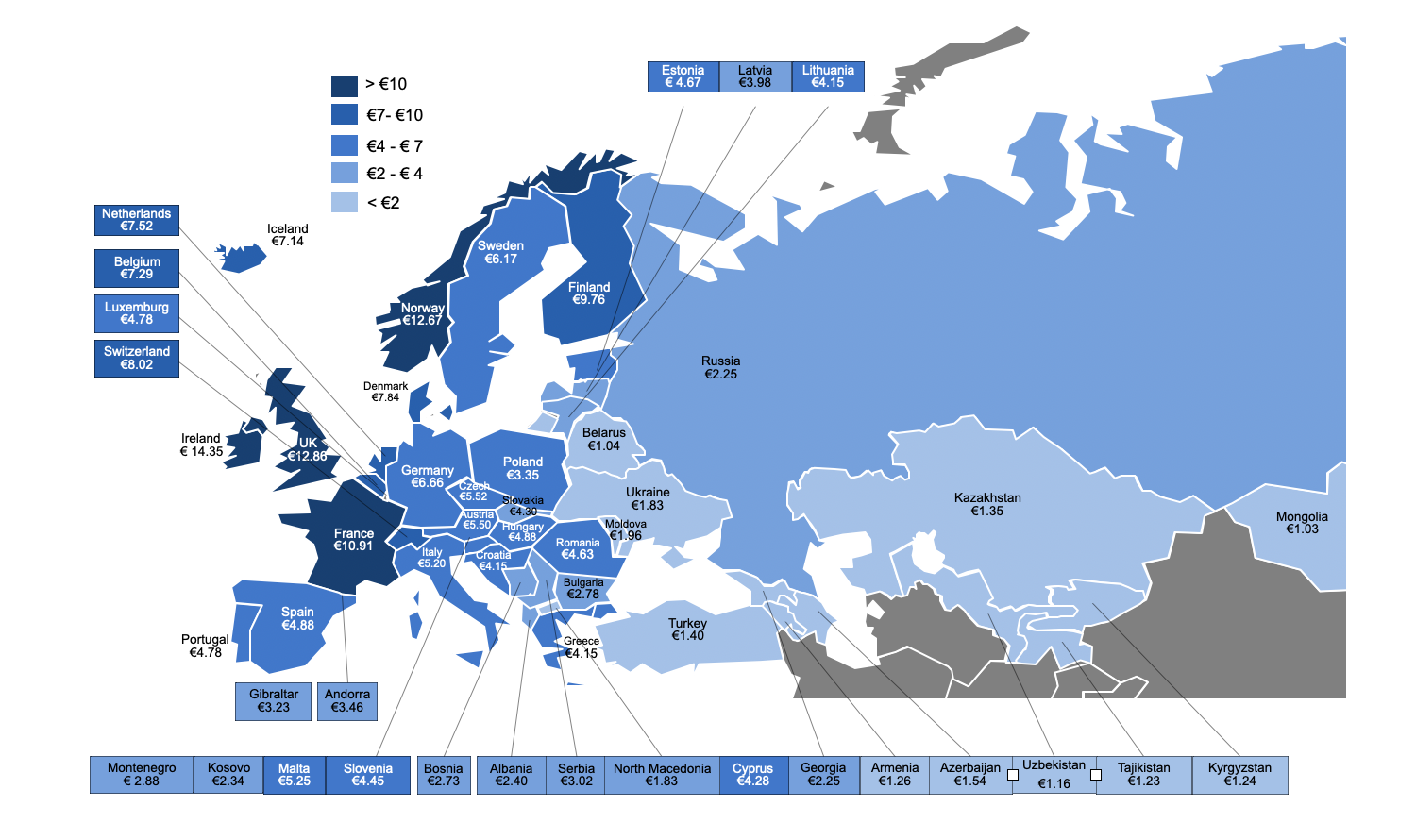

Furthermore, the reintroduction of duty-free shopping between the UK and the EU following the end of the Brexit transition period are having a significant impact on Irish retail tobacco sales. With Ireland ranked as the most expensive country in Europe to purchase duty paid tobacco, consumers are understandably taking advantage of the option to purchase cheaper product outside the State while travelling and bringing it back.

(Average price for package of 20 cigarettes – figures for 2019)

Large excise increases facilitate criminality

There is some acceptance at political level that excise increases are leading to an increase in illicit trade. Cigarettes in Ireland are now the most expensive cigarettes in the EU – increased excise drives consumers away from law-abiding retailers and into the arms of criminal gangs selling smuggled, cheaper, cigarettes. Those who purchase smuggled products knowingly do so because the deterrent or risk does not deter levels of illegal activity.

The first ever discovery of an illegal cigarette factory on Irish soil in March 2018 clearly demonstrates that the illegal trade of tobacco is going from strength to strength, with the methodology used by criminals constantly evolving. Up until now, illegal tobacco was assumed to have been sourced only through smugglers, both across the border and through our ports. A further five illegal production sites have been discovered across the island of Ireland since March 2018.

Excise is an unreliable and unsustainable source of revenue and cannot increase indefinitely

Tobacco excise forecasts on Budget day consistently over-estimate what is actually collected, for example in 2019 there was a shortfall of €16 million on tobacco excise returns. This leads to diminishing, if not negative, returns.

Excise is a regressive stealth tax and it disproportionately burdens lower and middle-income people

As lower-income earners are more likely to smoke, they also bear more of the tax burden than higher-income earners, in absolute terms and as a percentage of income. According to statistics from HSE’s Smoking Prevalence Tracker

2022, smoking rates are higher in more disadvantaged areas (35%) than in more affluent areas (9.2%).¹

Excise on cigarettes is a discriminatory tax on a minority of the population

Smokers represent about 18%2 of the population which is currently subject to discrimination due to the heavy taxation on a product that they consume. Tobacco taxes are part of the “divide and conquer” approach to taxation. Smokers are voters and citizens. As such, they should be treated fairly in terms of fiscal burden. This is not happening when it comes to tobacco taxation.

Excise on cigarettes hurt local businesses and the overall economy

Many people travel outside Ireland to buy their tobacco products, and now we know that counterfeit products are even manufactured domestically by criminal gangs. This hurts local businesses. Cigarettes in Ireland are now the most expensive cigarettes in the EU – increased excise drives consumers into the arms of criminal gangs selling smuggled, cheaper, cigarettes and away from law-abiding retailers and adult smokers.